Overview

- Examines typical barriers against migration in the Euro Area

- Investigates whether the EA has developed a better functioning of this stabilization mechanism since its beginning

- Draws policy recommendations

Access this book

Tax calculation will be finalised at checkout

Other ways to access

About this book

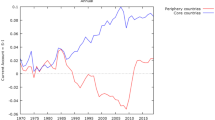

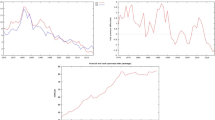

This book is the second of three volumes that uses the theory of Optimal Currency Areas (OCAs) and applied econometric techniques to provide the reader with a compact analysis of the Euro area, its evolution and future perspectives. Each volume of the series is dedicated to one of the three critical criteria for an OCA: 1) business cycle synchronization, 2) factor mobility and 3) the existence of a risk sharing system. This second volume deals with the criterion of factor mobility. The authors investigate and discuss whether there are signs of labor and capital mobility that have helped dampen economic shocks among the regions of the Euro during its short history. The book is of interest to a wide range of researchers in financial economics, macroeconomics and economic policy.

Similar content being viewed by others

Keywords

Table of contents (5 chapters)

-

Front Matter

-

Back Matter

Reviews

“This book makes a unique contribution to the assessment of Eurozone’s foundations and viability by drawing on factor mobility. It makes essential reading for all professionals keen in Eurozone economics and anyone with a genuine interest on the future of EU/Eurozone. Static and dynamic econometric analysis provide an excellent guide to quants specialists and at the same time navigates the non-specialist through the key issues relating to Eurozone’s capital and labour mobility in a very reader-friendly manner. In this way, readers' ability to evaluate Eurozone’s challenges is greatly enhanced while appreciating the complexities surrounding factor mobility.” (Dimitrios Syrrakos, Head of Economics, Keele Business School, UK.)

Authors and Affiliations

About the authors

Johannes Kabderian Dreyer is an associate professor of Financial Economics at Roskilde University. He holds a doctorate in Financial Economics from the Ingolstadt School of Management (Catholic University of Eichstätt-Ingolstadt, KU), financed by the German Academic Exchange Service (DAAD).

Peter Alfons Schmid is a professor for business administration, finance and entrepreneurship at the FOM University of Applied Sciences, and contract lecturer at the Free University Bolzano-Bozen. During his doctoral studies, he was teaching and research assistant at the Chair of Economic Theory of the KU, where he earned his doctorate.

Accessibility Information

Bibliographic Information

Book Title: Optimal Currency Areas and the Euro, Volume II

Book Subtitle: Capital and Labor Mobility

Authors: Johannes Kabderian Dreyer, Peter Alfons Schmid

DOI: https://doi.org/10.1007/978-3-031-38867-5

Publisher: Palgrave Pivot Cham

eBook Packages: Economics and Finance, Economics and Finance (R0)

Copyright Information: The Author(s), under exclusive license to Springer Nature Switzerland AG 2023

Hardcover ISBN: 978-3-031-38866-8Published: 24 August 2023

eBook ISBN: 978-3-031-38867-5Published: 23 August 2023

Edition Number: 1

Number of Pages: XIV, 123

Number of Illustrations: 11 b/w illustrations, 3 illustrations in colour

Topics: European Integration, Financial Crises, Macroeconomics/Monetary Economics//Financial Economics, International Finance, Economic Policy, European Economics